Panda Helper iOS

VIP Version Free Version Jailbroken Version- Panda Helper >

- iOS Apps >

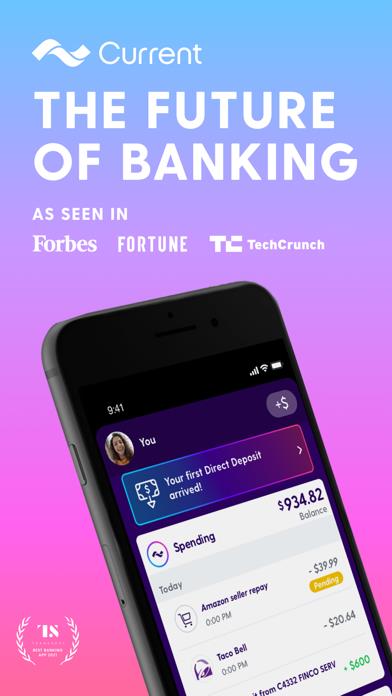

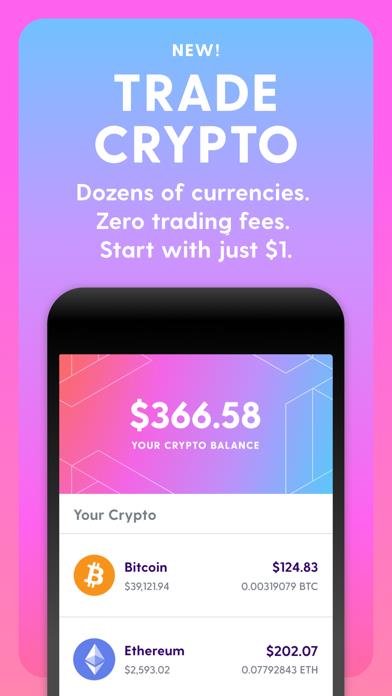

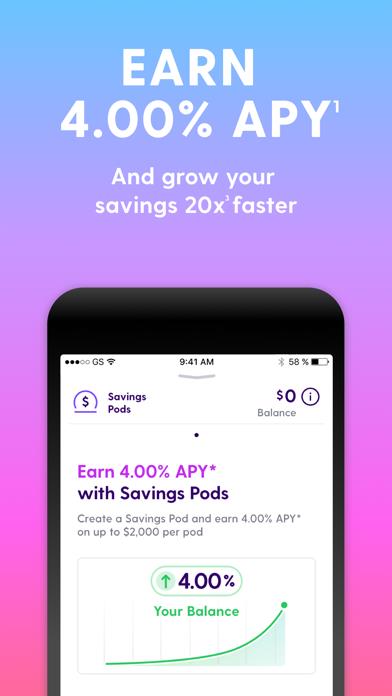

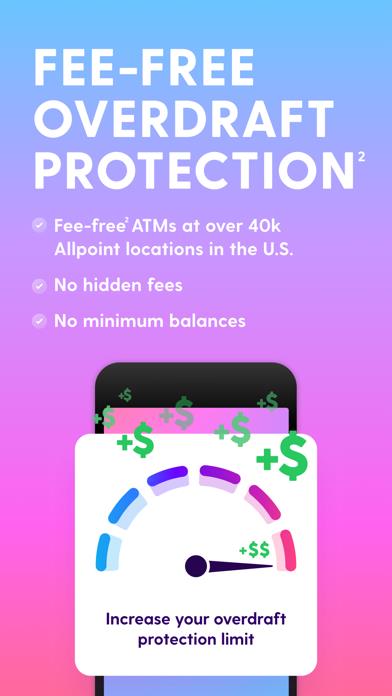

- Current: The Future of Banking

Current: The Future of Banking

- Sizes: 109.72MB

- Version: 6.6.2

- Update: 2023-05-17

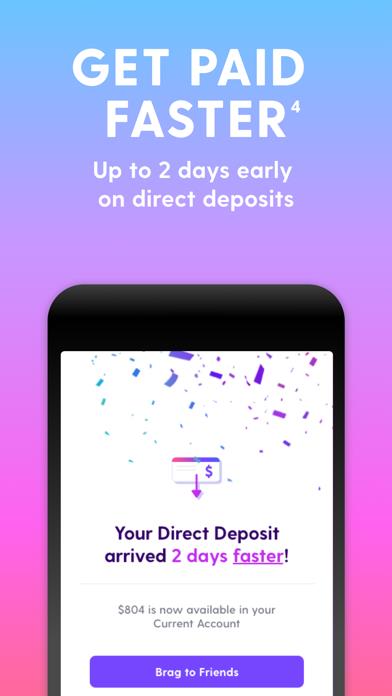

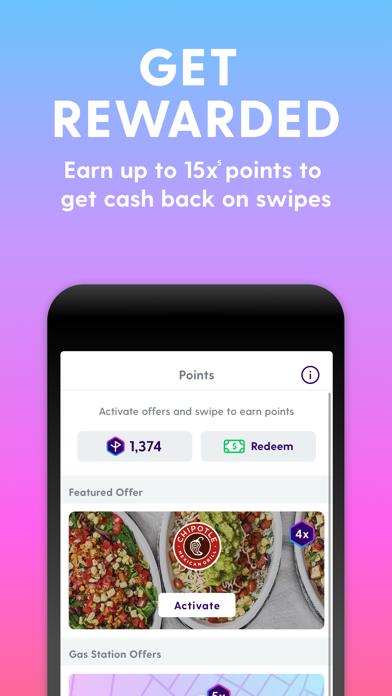

Current: The Future of Banking Screenshot

Current: The Future of Banking Description

Panda Features

Current: The Future of Banking Information

Name Current: The Future of Banking

Category Finance

Developer Finco Services, Inc.

Version 6.6.2

Update 2023-05-17

Languages EN

Size 109.72MB

Compatibility Requires iOS 12.0 or later. Compatible with iPhone, iPad, and iPod touch.

Other Original Version

Angry Birds Journey Hack Information

Rating

Tap to Rate

Panda Helper

App Market

Popular Apps

Latest News

copy successfully!